axis payroll User Guide Supplement March 2024 |

||

1. What's New? |

||

|

||

1.1 Employer Bulletins February 2024 and March 2024 |

||

|

You are advised to read the Employer Bulletin-February 2024 and Employer Bulletin-March 2024 which are available from the GOV.UK website |

||

1.2 P60 Stationery |

||

|

Employers continue to be required to supply all employees with a P60 if they are still in your employment at the end of each tax year. HMRC are no longer supplying pre-printed stationery. axis payroll prints the P60 documents to a PDF file from where the documents can then be printed on plain A4 paper and issued to your employees. Note: for axis payroll 2020 and 2022 users or those that have the Paperless Payroll Foundation feature, running Create P60 Atttachments will create an axis payroll password protected pdf version of the P60 on the employee record. Additionally, for axis payroll systems with the People HR Interface feature or the eDoc Deposit Interface feature, P60's can be delivered to your employees via their People HR or eDoc Deposit account. These are password protected and an additional password protected copy is stored in the attachments tab of the employee record in axis payroll.

|

||

1.3 National Insurance Contributions Rates |

||

|

On 6th March 2024, the government announced reductions in Class 1 employee National Insurance contributions from 10% to 8% from 6th April 2024. axis payroll software releases from 18th March 2024 will include these updated rates.

|

||

1.4 Employment Allowance from 6th April 2024 |

||

|

The annual Employment Allowance for eligible businesses remains at £5,000 for tax year 2024-2025.

|

||

1.5 Changes to Scottish Income Tax |

||

|

The Scottish Government have announced changes to Scottish Income Tax, which will take place from 6 April 2024 including the introduction of a new tax band, Advanced rate. For further details on those changes, please refer to the Scottish Income Tax 2024 to 2025 factsheet published by the Scottish Government. |

||

1.6 Changes to Paternity Leave and Pay |

||

|

HM Government is making changes to the way Paternity Leave and Pay can be claimed and taken from 6th April 2024, which allow fathers and partners to take their leave and Statutory Paternity Pay in non-consecutive blocks. Currently, only one block of leave can be taken, which can be either one or two weeks. It will also allow fathers and partners to take their leave and pay at any point in the first year after the birth or adoption of their child. axis payroll has been updated for these changes.

|

||

1.7 Rates and Thresholds for Employers |

||

|

The HMRC published rates and thresholds for employers 2024-2025 can be found at Rates and Thresholds for Employers 2024 to 2025 |

||

2. Information for axis payroll 2018 and axis payroll 2020 users

|

The document below is not the latest version. To see the latest version, please click here. |

The information contained in this Payroll User Guide Supplement applies to axis payroll 2018, axis payroll 2020 and axis payroll 2022 users. To remain up to date with the latest additional payroll functionality, we would recommend you complete an Upgrade Request if you are still running axis payroll 2018 or axis payroll 2020.

3. Preparation

|

The document below is not the latest version. To see the latest version, please click here. |

3.1 When Do I Install the Update?

Your axis payroll software must be updated before you will be able to perform the payroll 2023/24 year end.

You do not need to install this update until you have completed the final period of the year, however it is safe to install the update at any time.

3.2 Dates Of Birth

In order to allocate employees to the correct NI category, you must ensure that you hold the correct date of birth against each active employee record.

3.3 Employee Addresses

In order for HMRC to apply Scottish Rate of Income Tax and Welsh Rate of Income Tax correctly, it is important that employee addresses are kept up to date.

3.4 Employer Bulletin

You are advised to read the Employer Bulletin: February 2024 and Employer Bulletin March 2024 which are available for download from the GOV.UK website.

3.5 Year End Stationery

P60 bulk stationery was withdrawn by HMRC in 2021. P60's are printed to PDF for printing and distribution to your employees unless you are using our supported Paperless Payroll interfaces.

3.6 P45 Stationery

Similar to the P60, bulk stationery for P45 was withdrawn by HMRC in 2021.

P45's are now printed to PDF.

3.7 Week 53 / Week 1

The 2023/2024 tax year includes a Week 53 for weekly payrolls where the pay date lands on Thursday 4th April or Friday 5th April 2024.

3.8 Employment Allowance

If you have been eligible to claim the 'Employment Allowance' and have not yet submitted your claim for 2023-2024, you will need to go to 'Amend Employer Details' for the payroll data set through which you wish to claim the allowance and tick the 'Employment Allowance' option. Note: if you are operating more than one payroll data set, you should only claim through one data set.

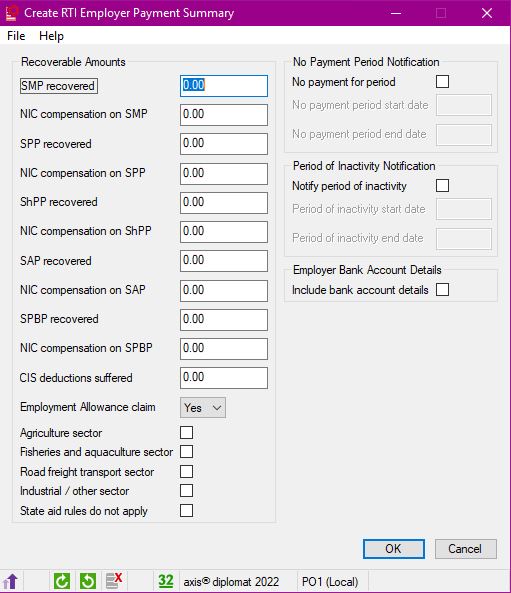

Your final Calculate Monthly Remittance for the year will then include your claim for the allowance. You will then need to set 'Employment Allowance claim' to 'Yes' when submitting your final end of year EPS to advise HMRC that you are making the claim.

4. Installing the Update

|

The document below is not the latest version. To see the latest version, please click here. |

4.1 Where Do I Install The Update?

The update must be installed on your axis payroll software server. This will usually be your network server, but a number of axis payroll users run their payrolls on a stand-alone PC.

4.2 Downloading the axis payroll software update

If you have the axis diplomat accounts package installed on the same server as your payroll, you can schedule a full axis diplomat software update from within axis diplomat for automatic overnight installation. Instructions on scheduling a software update can be found at Scheduling an axis diplomat software update

Alternatively, customers will manually download the update from our website as in previous years.

To manually download the update:

- Ensure you are logged on to your payroll server as an administrator.

- Ensure you are logged into your account at www.axisfirst.co.uk.

- Your software update can be downloaded from https://www.axisfirst.co.uk/payroll-march-2024 then selecting the appropriate download. Ensure that you read the terms and conditions fully before proceeding; an option is provided to print these if required. This area provides full instructions on installing software updates.

4.3 Installing the Update

If manually downloading the software update you will need to follow the Installation Procedure detailed below.

Scheduled software updates will complete full installation processes automatically.

Please note that you need only install this update once for all axis payrolls providing that all payrolls reside on the same machine. Where payrolls are 'switched' between 'home' and 'office', then each such machine requires the update.

4.3.1 Copy Data to Full Backup

Ensure that a full backup of the system is taken. Use the 'Copy Data to Full Backup' function to create an archive backup of the payroll data on to removable media. We also strongly recommend that a full backup of the axis programs and data is made.

4.3.2 Installing the Update

You should run the installation procedure from the axis payroll server.

- You should be logged onto the axis payroll server. Elevation will be required.

- Ensure that all axis users are out of the system. You can do this by clicking on the System Console/User Status Enquiry button, found on the axis payroll Scheduler toolbar. Then come out of the system yourself

- If installing a downloaded version of the software, the file needs to be on the axis server and so may need to be copied to the server either directly over the network or via a form of removable media if it has been downloaded on another workstation. The executable can then be run to install the update files.

- If installing from removable media, insert the update device into the server. The device should auto-run. If it does not, please call for assistance

- Click on Install/Upgrade axis diplomat (2018, 2020 or 2022) System.

- Click Upgrade Existing System.

- If you are continuing to use axis payroll 2018 or 2020, an information screen will appear:

Confirm that you wish to continue- Confirm that you accept the terms of the license agreement:

- Select the drive that contains your axis payroll system. This will normally be the default drive presented:

- The installation procedure will now check that there are still no users in the system, check for sufficient disk space and then ask you to confirm that you wish to update the axis diplomat software.

- The installation procedure will continue and update the axis payroll software.

- Once the installation has completed, you will receive a ‘Setup Completed Successfully’ message, click ‘OK’ and then ‘Cancel’ out of the menus.

- Finally, whilst you are still logged on to the axis server, you should enter each of your axis payroll systems in turn and perform any updates requested.

- This completes the installation procedure. Once the installation has completed, you will receive a ‘Setup Completed Successfully’ message, click ‘OK’ and then ‘Cancel’ out of the menus.

5. Year End Procedures

|

The document below is not the latest version. To see the latest version, please click here. |

Ensure that you have installed your axis payroll Legislation Update before proceeding with the year end procedures. Please ensure that a FULL security backup is taken of the payroll data BEFORE installing the axis payroll Legislation Update and again before running the last function ‘Year End Processing’.

You also need to ensure that you have:

- Run your final period end

- Run 'Calculate Monthly Remittance'

- Checked that your last submitted FPS is correct.

- Created and successfully submitted your final 'RTI Employer Payment Summary' (EPS) if this is your only payroll frequency and payroll data set or is the payroll frequency/payroll data set from which you have chosen to submit combined figures. You will need to submit a final year end EPS even if you have no statutory payments to recover in order to advise HMRC that you are making the final submission for the year.

Please note: HMRC accept the 'final submission for the year flag' in either the last submitted FPS file for the year or in the final EPS file. axis payroll only supports submission of this flag in the EPS and the file is automatically flagged in the background as the final submission for the year. Refer to http://www.gov.uk/payroll-annual-reporting/send-your-final-payroll-report for further information.

5.1 Reports to Run

Run the following reports for each payroll frequency from the Payroll Year End menu:

5.2 P60 Print

A P60 must be generated and delivered to each employee still employed on 5th April.

As HMRC have now withdrawn the bulk stationery for P60's and P45's, the P60 will need to be printed to PDF from your axis diplomat payroll system and then printed from the pdf viewer.

The documents are printed in surname order.

Please read the associated help documentation for further details.

For those axis payroll systems with a paperless payroll interface, Create P60 Attachments should be used in preference to the P60 Print function and the attachments should then be uploaded using Deliver P60 Attachments (see section below).

5.3 Create P60 Attachments

The Create P60 Attachments function is available to axis payroll 2020 and axis payroll 2022 users or if the People HR Interface or eDoc Deposit Interface features are set and will create a password protected pdf version of the P60 as an attachment on the employee record.

If a supported interface is being used to deliver payroll documents, this function should be used in preference to the P60 Print function. Documents are then delivered to the inteface using Deliver P60 Attachments.

5.4 End of Year Returns

You must ensure that you have successfully submitted an RTI Employer Payment Submission file if this is your only payroll frequency and payroll data set for the employer PAYE reference or is the payroll frequency/payroll data set from which you have chosen to submit combined figures before proceeding to use the Year End Processing function. You will need to submit a final year end EPS even if you have no statutory payments to recover in order to advise HMRC that you are making the final submission for the year.

Please note: HMRC accept the 'final submission for the year flag' in either the last submitted FPS file for the year or in the final EPS file. axis payroll only supports submission of this flag in the EPS and the file is automatically flagged in the background as the final submission for the year. Refer to http://www.gov.uk/payroll-annual-reporting/send-your-final-payroll-report for further information.

6. Year End Processing

|

The document below is not the latest version. To see the latest version, please click here. |

6.1 Security Back Up

You should now take a Year End Security Copy of all axis payroll Data using the 'Copy Data to Full Backup' function and selecting the 'Retain backup indefinitely' and 'Archive backup' options.

We would advise you to keep the backup archive for a minimum of 3 years in case of query from HM Revenue & Customs.

This is also important in case there is a problem with your end of year returns.

6.2 Year End Processing

The Year End Processing function needs to be run for each payroll frequency.

The system asks for confirmation that you have read and understood this guide before proceeding and that a security back up has been taken.

The process then clears all accumulators to zero for the new tax year.

The previous years’ details are retained in the Payroll Payment Archive File.

The Employment Allowance tick box located in Amend Employer Details is automatically cleared if your Employers National Insurance for tax year 2023/2024 exceeds £100,000.

Re-enter your payroll system.

7. The New Year

|

The document below is not the latest version. To see the latest version, please click here. |

7.1 Employment Allowance

The Employment Allowance remains at £5,000 per year from 6th April 2024.

Even if you were eligible for, and claimed, Employment Allowance for the tax year ending 5th April 2024, you will need to submit a fresh claim.

If you have are newly eligible to claim the 'Employment Allowance' you will need to go to 'Amend Employer Details' for the payroll data set through which you wish to claim the allowance and tick the 'Employment Allowance' option. Note: if you are operating more than one payroll data set, you should only claim through one data set. Calculate Monthly Remittance will then include your claim for the allowance.

You will also need to create and submit an RTI Employer Payment Summary in the first month of the tax year to advise HMRC that you are claiming the allowance by setting the 'Employment Allowance claim' option to 'Yes' and ticking the appropriate company sector option for your business (see https://www.gov.uk/guidance/changes-to-employment-allowance for further information).

7.2 Tax Code Changes

The standard personal allowance remains at £12,570. This applies to England and Northern Ireland, Scotland and Wales.

The code for standard / emergency use with effect from 6th April 2024 is 1257L.

Tax Code Uplifts are as follows:

- L: N/A due to no change in the Personal Allowance

- M: N/A due to no change in the Personal Allowance

- N: N/A due to no change in the Personal Allowance

Where you receive a code notification for an individual employee to be operated from 6th April 2024 on Form P9(T) or via your online HMRC account, the specified code must be entered after the year end has been run.

Refer to form P9X(2024) for further details.

7.3 Class 1 National Insurance Contributions

Calculate Net Pay will check the tax year / pay date and automatically apply the following Class 1 earnings thresholds effective from 6th April 2024:

| Weekly | Monthly | Yearly | |

| Lower Earnings Limit | £123.00 | £533.00 | £6,396.00 |

| Primary Threshold | £242.00 | £1,048.00 | £12,570.00 |

| Secondary Threshold | £175.00 | £758.00 | £9,100.00 |

| Freeport Upper Secondary Threshold | £481.00 | £2,083.00 | £25,000.00 |

| Investment Zone upper secondary limit | £481.00 | £2,083.00 | £25,000.00 |

| Upper Secondary Threshold (Under 21) (UST) | £967.00 | £4,189.00 | £50,270.00 |

| Apprentice Upper Secondary Threshold (Apprentice Under 25) (AUST) | £967.00 | £4,189.00 | £50,270.00 |

| Veterans Upper Secondary Threshold | £967.00 | £4,189.00 | £50,270.00 |

| Upper Earnings Limit | £967.00 | £4,189.00 | £50,270.00 |

The Class 1 National Insurance rates are available at https://www.gov.uk/guidance/rates-and-thresholds-for-employers-2024-to-2025

Calculate Gross Pay will continue to check employees in the 'under 21' and 'under 25' N.I. categories and amend their category to a standard category if that employee has achieved the age of 21 or 25 by the pay date of the period being run.

Note: Print Payroll Parameters, accessed from the 'Supervisor Functions' menu, may also be used to produce a report of the rates applicable to each NI category and band of earnings.

7.4 Statutory Sick Pay

The weekly rate increases to £116.75.

The appropriate daily rate is determined by the number of qualifying days.

Eg. The daily rate for an employee with five qualifying days is £23.35.

7.5 Statutory Maternity / Paternity / Adoption / Shared Parental and Parental Bereavement Pay

Statutory Maternity Pay (SMP) and Statutory Adoption Pay (SAP) are paid at 90% of the employee's average weekly earnings for the first six weeks. The standard weekly rate for the remaining weeks is £184.03 or 90% of the employee's average weekly earnings, whichever is lower.

Statutory Paternity Pay (SPP) is payable for 1 or 2 weeks at the standard weekly rate of £184.03 or 90% of the employee's average weekly earnings, whichever is lower. From 6th April 2024, Statutory Paternity Leave and Pay may be split over two separate weeks.

Statutory Shared Parental Pay (ShPP) and Statutory Parental Bereavement Pay (SPBP) are payable at the standard weekly rate of £184.03 or 90% of the employee's average weekly earnings, whichever is lower.

The amount of SMP/SPP/ShPP/SAP/SPBP that may be recovered for employers who do not qualify for Small Employers Relief (SER) is 92% of the SMP/SPP/ShPP/SAP/SPBP paid to their employees.

Employers who do qualify for Small Employers Relief (SER) can recover 100% of the SMP/SPP/ShPP/SAP/SPBP paid to their employees plus NIC compensation of 3%.

A ‘small employer’ is one who paid (or was liable to pay) total gross class 1 NICs of £45,000 or less in the individuals qualifying tax year. For further information please refer to https://www.gov.uk/recover-statutory-payments

7.6 Student Loan and Postgraduate Loan Recovery

The annual employee earnings threshold for the collection of existing Plan 1 Student Loans increases to £24,990.

The annual employee earnings threshold for the collection of Plan 2 Student Loans remains at £27,295.

The annual employee earnings threshold for the collection of Plan 4 Student Loans increases to £31,395.

The deduction percentage rate for student loans remains unchanged at 9% of earnings above the threshold.

The annual employee earnings threshold for the collection of Postgraduate loans for 2024/2025 remains at £21,000 and deductions are made at 6%.

7.7 PAYE Income Tax

Calculate Net Pay will automatically apply the appropriate annual tax bands for the tax year / pay date as follows:

|

2024 - 2025 |

||

| England & Northern Ireland Basic Rate | 20% | £1 to £37,700 |

| England & Northern Ireland Higher Rate | 40% | £37,701 to £125,140 |

| England & Northern Ireland Additional Rate | 45% | £125,141 and above |

| Scottish Starter Rate | 19% | £1 - £2,306 |

| Scottish Basic Rate | 20% | £2,307 to £13,991 |

| Scottish Intermediate Rate | 21% | £13,992 to £31,092 |

| Scottish Higher Rate | 42% | £31,093 to £62,430 |

| Scottish Advanced Rate | 45% | £62,431 to £125,140 |

| Scottish Top Rate | 48% | £125,141 and above |

| Welsh Basic Rate | 20% | £1 to £37,700 |

| Welsh Higher Rate | 40% | £37,701 to £125,140 |

| Welsh Additional Rate | 45% | £125,141 and above |

The bands for 2024-25 are effective from the first pay day on or after 6th April 2024.

NB. A report of current statutory deduction and payment rates can be produced using Print Payroll Parameters which is located on the Supervisor Functions menu.

7.8 Pension Scheme Qualifying Earnings

As the qualifying earnings are reviewed annually, please contact your pension scheme provider to see if there are any changes.

If so, this can be changed in Amend Pension Scheme Details.

By law, the total minimum amount of contributions which must be paid into workplace pension schemes increased on 6th April 2019. Employers must make a minimum contribution towards this amount and the staff member must make up the difference. If you decide to cover the total minimum contribution required, your staff won’t need to pay anything.

This table shows the minimum contributions you must pay and the dates when they increased:

| Date | Employer minimum contribution | Staff Contribution | Total minimum contribution |

| Until 5th April 2018 | 1% | 1% | 2% |

| 6th April 2018 to 5th April 2019 | 2% | 3% | 5% |

| 6th April 2019 onwards | 3% | 5% | 8% |

Please see https://www.axisfirst.co.uk/documentation/WorkPlace-Pensions/articles/18778 for detailed information on managing workplace pensions in axis payroll.The staff contribution rate may vary depending on the type of tax relief applied by your scheme. If you are unsure check your scheme documents.

7.9 Payrolling Company Car Benefits

If you are payrolling company car benefits, you will need to update the current car details for each employee to provide the 'Date first registered'.

If the vehicle fuel type is Hybrid, you will also need to complete the 'Zero emissions mileage value'.

These changes need to be made before your first payroll run of the new year.