axis payroll User Guide Supplement March 2023 |

||||||||||||||||||||||||||||||||||||

7. The New Year |

||||||||||||||||||||||||||||||||||||

7.1 Employment Allowance |

||||||||||||||||||||||||||||||||||||

|

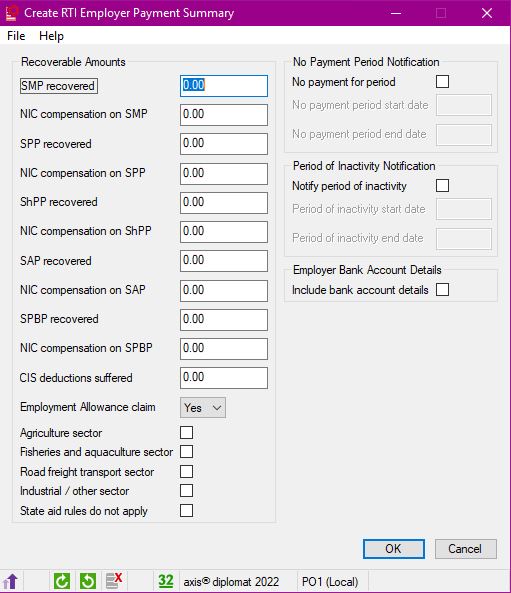

The Employment Allowance remains at £5,000 per year from 6th April 2023. Even if you were eligible for, and claimed, Employment Allowance for the tax year ending 5th April 2023, you will need to submit a fresh claim. If you have are newly eligible to claim the 'Employment Allowance' you will need to go to 'Amend Employer Details' for the payroll data set through which you wish to claim the allowance and tick the 'Employment Allowance' option. Note: if you are operating more than one payroll data set, you should only claim through one data set. Calculate Monthly Remittance will then include your claim for the allowance. You will also need to create and submit an RTI Employer Payment Summary in the first month of the tax year to advise HMRC that you are claiming the allowance by setting the 'Employment Allowance claim' option to 'Yes' and ticking the appropriate company sector option for your business (see https://www.gov.uk/guidance/changes-to-employment-allowance for further information).

|

||||||||||||||||||||||||||||||||||||

7.2 Tax Code Changes |

||||||||||||||||||||||||||||||||||||

|

The standard personal allowance remains at £12,570. This applies to England and Northern Ireland, Scotland and Wales. The code for standard / emergency use with effect from 6th April 2023 is 1257L. Tax Code Uplifts are as follows:

Where you receive a code notification for an individual employee to be operated from 6th April 2023 on Form P9(T) or via your online HMRC account, the specified code must be entered after the year end has been run. Refer to form P9X(2023) for further details. |

||||||||||||||||||||||||||||||||||||

7.3 Class 1 National Insurance Contributions |

||||||||||||||||||||||||||||||||||||

|

Calculate Net Pay will check the tax year / pay date and automatically apply the following Class 1 earnings thresholds effective from 6th April 2023:

The Class 1 National Insurance rates are available at https://www.gov.uk/guidance/rates-and-thresholds-for-employers-2023-to-2024 Calculate Gross Pay will continue to check employees in the 'under 21' and 'under 25' N.I. categories and amend their category to a standard category if that employee has achieved the age of 21 or 25 by the pay date of the period being run. Note: Print Payroll Parameters, accessed from the 'Supervisor Functions' menu, may also be used to produce a report of the rates applicable to each NI category and band of earnings.

|

||||||||||||||||||||||||||||||||||||

7.4 Statutory Sick Pay |

||||||||||||||||||||||||||||||||||||

|

The weekly rate increases to £109.40. The appropriate daily rate is determined by the number of qualifying days. Eg. The daily rate for an employee with five qualifying days is £21.88.

|

||||||||||||||||||||||||||||||||||||

7.5 Statutory Maternity / Paternity / Adoption / Shared Parental and Parental Bereavement Pay |

||||||||||||||||||||||||||||||||||||

|

Statutory Maternity Pay (SMP) and Statutory Adoption Pay (SAP) are paid at 90% of the employee's average weekly earnings for the first six weeks. The standard weekly rate for the remaining weeks is £172.48 or 90% of the employee's average weekly earnings, whichever is lower. Statutory Paternity Pay (SPP) is payable for 1 or 2 weeks at the standard weekly rate of £172.48 or 90% of the employee's average weekly earnings, whichever is lower. Statutory Shared Parental Pay (ShPP) and Statutory Parental Bereavement Pay (SPBP) are payable at the standard weekly rate of £172.48 or 90% of the employee's average weekly earnings, whichever is lower. The amount of SMP/SPP/ShPP/SAP/SPBP that may be recovered for employers who do not qualify for Small Employers Relief (SER) is 92% of the SMP/SPP/ShPP/SAP/SPBP paid to their employees. Employers who do qualify for Small Employers Relief (SER) can recover 100% of the SMP/SPP/ShPP/SAP/SPBP paid to their employees plus NIC compensation of 3%. A ‘small employer’ is one who paid (or was liable to pay) total gross class 1 NICs of £45,000 or less in the individuals qualifying tax year. For further information please refer to https://www.gov.uk/recover-statutory-payments |

||||||||||||||||||||||||||||||||||||

7.6 Student Loan and Postgraduate Loan Recovery |

||||||||||||||||||||||||||||||||||||

|

The annual employee earnings threshold for the collection of existing Plan 1 Student Loans increases to £22,015. The annual employee earnings threshold for the collection of Plan 2 Student Loans remains at £27,295. The annual employee earnings threshold for the collection of Plan 4 Scottish Student Loans increases to £27,660 The deduction percentage rate for student loans remains unchanged at 9% of earnings above the threshold. The annual employee earnings threshold for the collection of Postgraduate loans for 2023/2024 remains at £21,000 and deductions are made at 6%.

|

||||||||||||||||||||||||||||||||||||

7.7 PAYE Income Tax |

||||||||||||||||||||||||||||||||||||

|

Calculate Net Pay will automatically apply the appropriate annual tax bands for the tax year / pay date as follows:

The bands for 2023-24 are effective from the first pay day on or after 6th April 2023. NB. A report of current statutory deduction and payment rates can be produced using Print Payroll Parameters which is located on the Supervisor Functions menu.

|

||||||||||||||||||||||||||||||||||||

7.8 Pension Scheme Qualifying Earnings |

||||||||||||||||||||||||||||||||||||

|

As the qualifying earnings are reviewed annually, please contact your pension scheme provider to see if there are any changes. If so, this can be changed in Amend Pension Scheme Details. By law, the total minimum amount of contributions which must be paid into workplace pension schemes increased on 6th April 2019. Employers must make a minimum contribution towards this amount and the staff member must make up the difference. If you decide to cover the total minimum contribution required, your staff won’t need to pay anything. This table shows the minimum contributions you must pay and the dates when they increased:

|

||||||||||||||||||||||||||||||||||||

7.9 Payrolling Company Car Benefits |

||||||||||||||||||||||||||||||||||||

|

If you are payrolling company car benefits, you will need to update the current car details for each employee to provide the 'Date first registered'. If the vehicle fuel type is Hybrid, you will also need to complete the 'Zero emissions mileage value'. These changes need to be made before your first payroll run of the new year. |

||||||||||||||||||||||||||||||||||||