axis diplomat 2008 Accounts Support Notes |

|

3. January 2010 UK VAT Rate Changes Supplement - Amending VAT Rates For Existing Orders |

|

|

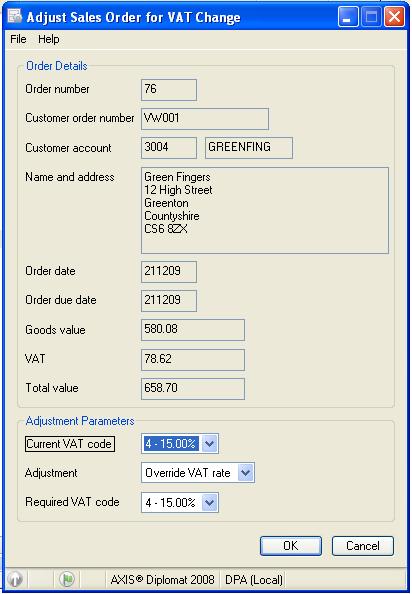

As indicated in Application Support Note 23237544 (1st January 2010 - UK VAT Rate Changes), the increase in standard VAT rate from 15.00% to 17.50% on 1st January 2010 may result in you needing to consult the guidance supplied by HMRC to assist you with determining the correct rate of VAT to apply to orders received prior to 1st January 2010. Examples of this would typically include pre-paid sales orders which can not be shipped until after 31st December 2009 and orders for which a total price including VAT has been agreed at 15.00% but due to shipment and payment timing will now need to be inclusive of VAT at 17.50%. Typically, affected axis diplomat users would include those with retail websites and mail order transactions. Normal Business-to-Business supplies are unlikely to be affected and only the changes in Application Support Note 23237544 need be applied. http://www.hmrc.gov.uk/vat/forms-rates/rates/rate-changes.htm For users of axis diplomat versions 2006 and above, we have made some enhancements to the software to assist you with applying the appropriate VAT rates to your sales orders. These changes include providing:

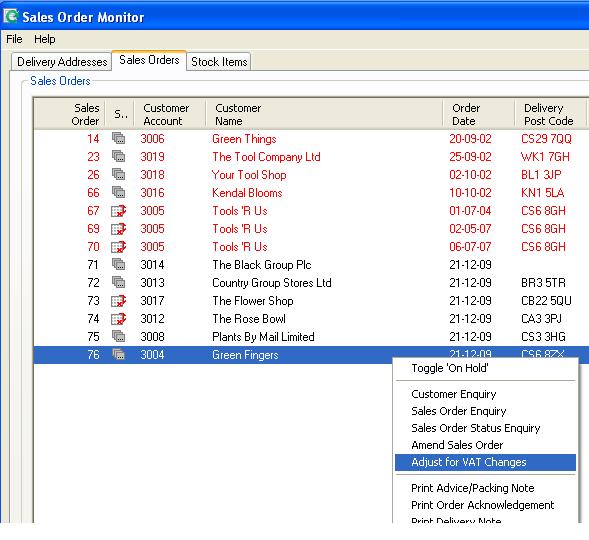

These actions will need to be applied on an order-by-order basis and we strongly recommend that you consult the HMRC documentation (see link above) prior to over-riding the VAT rate on any sales orders. The Update for axis diplomat 2006 and axis diplomat 2008 can be downloaded by clicking here. The interface for these changes has been provided as a right-click option from the Sales Orders tab of the Sales Order Monitor.

|

|