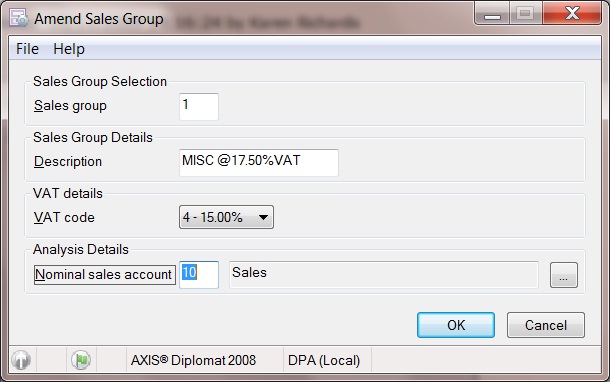

On 24th of November 2008, the UK government announced a change in the standard rate of VAT from 17.50% to 15.00%, with effect from the 1st December 2008. This change was announced as a temporary change, lasting 13 months until the end of 2009. To this effect, this support note has been raised to assist you with updating your axis diplomat system to return to the previous standard VAT rate of 17.50% which is effective from 1st January 2010.

If either of these apply then you should consult the HMRC guidelines for further information (see links below).

axis diplomat fixes the VAT rate at the point a Sales Order is released since this is the point you are telling the system that the goods or services have been supplied, and in most circumstances, this corresponds to the tax point. Different situations may arise, depending on whether you are releasing the Sales Order to Goods on Account or releasing the Sales Order to Invoice:

Releasing Sales Orders to Goods on Account

axis diplomat will have recorded the VAT against each Goods on Account booking line at the time they were created. This means that (if you follow the guidelines above), for sales orders released to Goods on Account before the 1st January 2010 the resultant invoice will include VAT at 15.00% regardless of when the invoice is generated. The HMRC guidelines state, however, that if the invoice is generated within fourteen days of the supply of the goods then the invoice date becomes the tax point.

This could mean that (depending on timing) if you invoice your Goods on Account bookings between 1st January 2010 and 14th January 2010 for goods or services supplied during the last two weeks of December 2009 then you could possibly need to charge VAT at 17.50% rather than 15.00%. If more than fourteen days elapse between the supply of the goods or services and the generation of the invoice then the tax point remains as the date of the supply of the goods or services and in this scenario the VAT rate would remain as 15.00%.

You should therefore ensure that you have either invoiced all of your Goods on Account Bookings at the end of December 2009 or that you ensure that more than fourteen days has elapsed between the December 2009 supply of goods or services and the raising of a corresponding January invoice.

Releasing Sales Orders to Invoice

When you release a Sales Order to Invoice then axis diplomat uses the VAT code indicated by the Sales Groups against the stock items on that Sales Order at that time and does not use the VAT code in force at the time that the Sales Order was entered. In other words, you can enter a Sales Order in December 2009 for an item for which VAT will be charged at 15.00% and if you release that Sales Order in January 2010 then (assuming that you have followed the guidelines above) the invoice will include VAT at 17.50%.

You should therefore ensure that, if you are unable to invoice Sales Orders for goods or services supplied during December 2009 until January 2010, less than fourteen days elapse before the invoice is generated so that the tax point becomes the date of the January 2010 invoice.

If you have orders that were placed prior to the 1st January 2010 but will not be shipped until after that date then you may need to make adjustments to those orders. You should consult the HMRC guidelines to determine what changes are required. If amendments to sales orders are required, please consult our supplementary Application Support Note 23237545. Typical situations where this may apply include

- orders where payment was received in 2009 but goods will not be supplied until 2010

- orders where a contract (or card authorisation) means that an existing order must be supplied at a given gross amount even though the VAT rate will change

- orders received in 2009 which will be shipped in 2010 but where Pro Formas are needed showing the new VAT rate before they generally apply

If any of these situations is likely to be a common occurence then this supplementary Application Support Note also contains a downloadable update for axis diplomat 2006 and axis diplomat 2008 which will make these updates easier to perform.

Customers that raise invoices for deposits against goods or services not yet supplied should also consult the HMRC documentation for further advice.

HM Revenue & Customs has produced a document relating to the VAT changes, this can be downloaded with the link below: