COVID-19 Related News

Seasonal Opening Hours 2024

We would like to take this opportunity to wish all of our customers a very Merry Christmas and a Prosperous New Year. Our Opening Hours for the holiday period are as follows: December ...

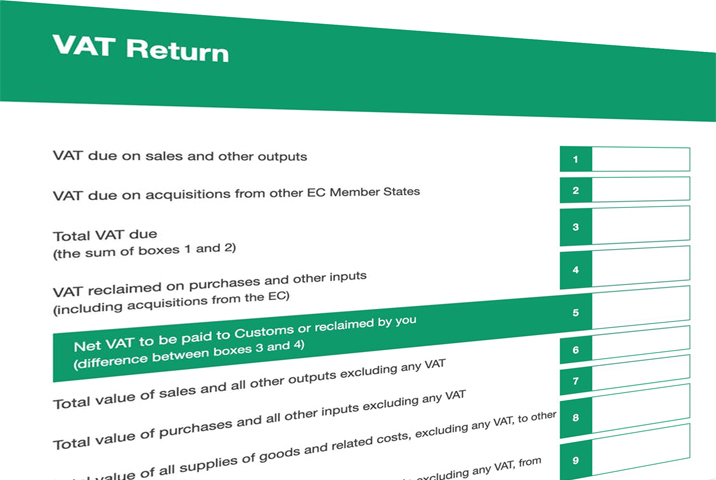

Reminder - 31st October 2020 End of Temporary VAT Rate for PPE

On 30th April, HMRC announced that there would be a temporary change to the VAT status of Personal Protection Equipment (PPE). From 1st May until 31st October, the supply of PPE recommended for use in connection with protection from infection with ...

Construction Industry Domestic Reverse Charge VAT Delayed

The introduction of Domestic Reverse Charge for construction services will be delayed until 1st March 2021. This is due to the impact of the coronavirus pandemic on the construction industry. When the reverse charge comes into force, ...

Temporary VAT Rate for PPE extended to 31st October

The temporary scrapping of VAT on PPE has been extended until the end of October. When the temporary zero rate of VAT for PPE was announced on the 30th ...

July 2020 - VAT Rate Reduction On Hot Food, Holiday Accommodation and Attractions

On 8th July 2020, the UK government announced a reduction in the rate of VAT on sales of any eat-in or hot takeaway food and drinks from restaurants, cafes and ...

Tax treatment of reimbursed expenses for home office equipment

To make it easier for your employees to remain productive while working at home without incurring a liability to income and NICs, the government has introduced ...

HMRC SSP Rebate Scheme Online from 26th May

HMRC have announced that the Coronavirus Statutory Sick Pay Rebate Scheme will be online from 26th May. The scheme enables employers with fewer than 250 ...

VAT Changes for PPE

On 30th April, HMRC announced that there would be a temporary change to the VAT status of Personal Protection Equipment (PPE). From 1st May until 31st July, ...

HMRC Webinars available on YouTube

If you missed any of the HMRC live webinars on helping businesses through the coronavirus / COVID-19 pandemic, they are now available on YouTube. Topics ...

Listings on Google Shopping to become free later this year

To help retailers affected by COVID-19, Google will, from next week, make it free for merchants to list their products on Google Shopping in the United ...

People HR Interface for axis payroll

Paperless Payroll Documents with axis payroll and People HR® We are pleased to announce the release of a new module for axis payroll offering ...

HMRC publishes guide to SSP and COVID-19

HM Revenue & Customs has today published a guide on claiming back Statutory Sick Pay paid to employees due to Coranavirus / COVID-19. The Coronavirus ...

Amazon's Changing Delivery Promise

As anyone shopping on Amazon in recent days will probably have noticed, their Prime delivery lead time for all non-essential goods is now 4 ...

VAT Payment Deferral Scheme

On the 20th March, the Chancellor announced a VAT payments deferral scheme to help businesses with their cashflow during the COVID-19 pandemic. All ...

Information on SSP for axis payroll Users

Last week, the UK government announced that Statutory Sick Pay (SSP) will be paid from the first day of absence for individuals solely affected by the ...

axisfirst Business Continuity Plans for COVID-19

In response to the current Coronavirus / COVID-19 outbreak, axisfirst has published plans for maintaining business continuity in the event of an escalation in ...